7th CPC Salary Calculator Central Government 2024

7th CPC Salary Calculator Central Government 2024: As a rule, all central government employees receive certain allowances on top of their basic salary. Some employees belonging to specific groups are eligible for particular allowances due to their distinctive job responsibilities. For instance, industrial personnel may receive the Night Duty Allowance for working after 10 PM. However, all groups of central government employees and officers are granted basic grants such as the Dearness Allowance, Transport Allowance, and House Rent Allowances based on their basic salary. This tool has been created to provide results based on an employee’s basic pay.

Inside Topics

| Head Topic | Salary Calculator |

| Beneficiaries | Central Govt Employees |

| Methodology | As per the 7th CPC |

| Effective From | 1.1.2016 |

| Salary Structure | Pay Matrix Level & Basic Pay |

| Revised on | 1.2.2024 |

Basic Salary Calculator Central Government

For Central Government employees seeking information regarding their monthly salary, there is a helpful tool available to gain insight into their compensations for the current month. The Indian Government operates Central Government facilities throughout India, including cities, towns, and rural regions.

Depending on the location of the workplace, salary packages may vary with differences between metropolitan and rural areas. To aid in salary calculations, a user-friendly online tool is available that is both simple and free to use. By entering basic salary and allowances, Central Government employees can utilize this tool to evaluate their compensation package.

Pay Matrix Level and Basic Pay

The Central government employees experienced a new and revised pay structure in Jan 2016 after the 7th CPC was implemented. The PAY MATRIX table was used to execute the pay progression, and it was designed to enhance transparency. This table consists of two dimensions: horizontal hierarchy and vertical basic pay progression through 40 different stages. Level 1 and Rs. 18000 is the minimum starting basic pay level mentioned in the table.

We have created a user-friendly online tool that follows the same Pay Matrix Table pattern. You can select your Pay Matrix Level and corresponding basic salary using our tool, and the results will be displayed immediately.

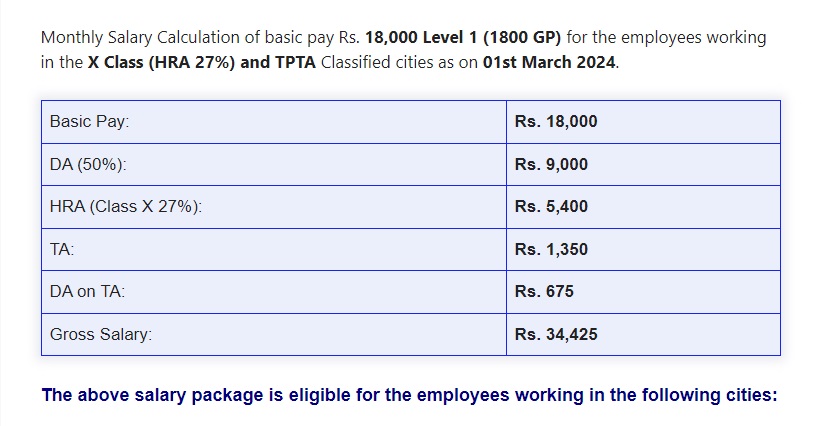

50% DA Gross Salary Calculator 2024

A new DA Gross Salary Calculator for 2024 has been approved by the Cabinet for Central Government employees, resulting in a 50% increase effective on 1st January 2024. This new package will revise the take-home salary for those working in the government sector.

An online tool is available to display the pay package for all grades and levels in the central government, simply requiring the selection of pay matrix level and basic salary. The tool will immediately calculate the monthly salary with all applicable allowances upon entry of the required details.

Allowances Paid to Central Govt Employees

Central Government Employees receive various allowances including HRA, Transport Allowance, and Dearness Allowance, which are granted based on work nature, posting place, and post hierarchy. These allowances were reviewed by the 7th CPC in 2016, and recommendations were implemented from 1st January 2016.

A committee was also formed to study these recommendations for allowances, and certain allowances were revised or abolished. Some of the prominent allowances for Central Government Employees include Children Education Allowance, Leave Travel Concession and Non-Practicing Allowance.

Gross and Take Home Salary Calculation

The calculation of the gross salary in the Central government includes the sum of basic pay, dearness allowance, house rent allowance, transport allowance, and any particular allowances given. On the other hand, take-home salary refers to the remaining amount after the mandatory government and private deductions are subtracted from the total salary.

Important Deductions of Central Govt Employees

One of the primary deductions that can be made on a monthly or yearly basis is the TDS for income tax purposes. Another deduction is the CGEGIS subscription amount, which is based on pay level. Then there is the compulsory deduction for either the Provident Fund or NPS.

If a loan, such as a medical, festival, computer advance, or HBA is obtained, then there will be a monthly installment deduction. Lastly, the pay slip will show a deduction for monthly charges of the Licence fee for government quarters, in addition to HRA.

Salary Calculation on Classification of Cities

When determining an employee’s salary, the location of their office is a critical factor to consider. The employee’s salary is determined based on where they work, whether it’s in a city, urban, or village area. To cover housing expenses, most organizations, including both government and private sectors, allocate a certain percentage of an employee’s basic salary.

The percentage of the Housing Rent Allowance (HRA) is determined based on the city or town’s classification. The HRA amount is then calculated based on the employee’s basic salary, with percentages ranging from 27% to 9% for different categories of cities and towns. For instance, if an individual’s basic salary is Rs. 49,000, the corresponding HRA amount would be Rs. 13,230, Rs. 8,820, or Rs. 4,410 depending on the applicable percentage.

How to Use the Salary Calculator

The TEUT Calculator provides a Pay Matrix level and basic salary drop-down menu. To make use of the tool, you need to select your Pay Matrix level, and Basic Pay and hit the submit button. The calculator will then present a comprehensive salary package overview divided into four categories based on the classification of cities and towns for House Rent Allowance and Transport Allowance.

Top Suggested Posts:

- Expected DA July 2024 Calculator

- Expected IDA April 2024 Calculator

- KVS Age Eligibility Calculator 2024-25

- Train Booking Date Calculator

- 12th Cut-Off Mark Calculator 2024

What is the minimum salary in the Central government?

As of Dec 2023, the minimum gross salary in the Central government is Rs. 33651 including 46% of DA.

How many allowances are granted to Central Government employees?

The 7th CPC recommends 196 allowances for Central Govt Employees. Dearness, Transport, and House Rent are the primary allowances for all employees.

What is the top allowance in the salary slip of Central government employees?

The most significant allowance reflected in the salary slip of Central government employees is the Dearness Allowance, which is updated every six months.